open ended investment company regulations

The federal securities laws categorize investment companies into three basic types. IC-9384 - July 30 FOUNDATIONSTOCKFUND.

Mutual Funds Regulation In India All You Need To Know

Regulation 23 The Open-Ended Investment Companies Regulations 2001.

. 1 The annual report of an open-ended investment company must in respect of the annual accounting period to which it relates contain accounts of the company. A resolution of the Company in general meeting or of a class meeting as the case may be passed by a simple majority of the votes validly cast whether on a show of. Different requirements apply to the marketing of the shares or securities issued by abody corporatewhich is an open-ended investment company compared with one that is not see PERG 9101 Gto PERG 9106 GMarketing of shares or securities issued by a body corporate.

Regulations are made this 29th day of October 2003. These Regulations are made under the Collective Investment Schemes Act 2003 and with it make provision for the constitution and management of open-ended investment companies which are incorporated in Uganda referred to in these Regulations as companies. These Regulations amend the Open-Ended Investment Companies Regulations 2001 SI.

The terms OEIC and ICVC are used interchangeably with different investment. The OpenEnded Investment C- ompanies Regulations 2001 SI 20011228 Ordinary Resolution. 2001-1228 the principal Regulations to allow open-ended investment companies to dispense with the holding of annual general meetings.

They also make other consequential amendments to the principal Regulations. Company Bakeries for an order under Section 6 c retroactively exempting from the provisions of Section 17 a 2 of the Act the purchase by Bakeries of shares of its common stock from Mathers Fund Inc an open-end investment company registered under the Act. A Shareholder is not liable to make any further payment after he has paid the price of his Shares in the Company and no further liability can be imposed on him in respect of the Shares which he holds.

OEICs are designed to allow individual and institutional investors to invest in a well-diversified and professionally managed portfolio in a relatively cost-effective and tax-efficient manner. Regulation 30 The Open-Ended Investment Companies Regulations 2001. THE OPEN-ENDED INVESTMENT COMPANIES REGULATIONS 2001 INSTRUMENT OF INCORPORATION of JANUS HENDERSON GLOBAL FUNDS An Investment Company with Variable Capital Registered in England and Wales under registered number IC 69 This document is dated and is valid as at 20 November 2020 EVERSHEDS SUTHERLAND INTERNATIONAL LLP One.

These Regulations are made under section 262 of the Financial Services and Markets Act 2000. Some types of open-ended investment companies called unit investment trusts in the US. The Open ended Investment Companies Amendment Regulations 2005 by Great Britain Enabling power.

We are experiencing technical difficulties. 2 The companys auditors must. They make provision for facilitating the carrying on of.

As defined in section 236 of the Act Open-ended investment companies a collective investment scheme which satisfies both the property condition and the investment condition. Financial Services and Markets Act 2000 s. The Company is an open-ended investment company with variable share capital.

And unit trusts in the UK may expire at a certain point in time. A resolution of the Company in general meeting or of a Class meeting as the case may be passed by a simple majority of the votes validly cast whether on a show of hands or on a poll for and against the resolution at such meeting. The Open-Ended Investment Companies Regulations 2001 SI 20011228.

THE OPEN-ENDED INVESTMENT COMPANIES REGULATIONS 2001 INSTRUMENT OF INCORPORATION of JANUS HENDERSON STRATEGIC INVESTMENT FUNDS An Investment Company with Variable Capital Registered in England and Wales under registered number IC 312 This document is dated and is valid as at 31 October 2020 EVERSHEDS SUTHERLAND. The Shareholders are not liable for the debts of the Company. An open-ended investment company abbreviated to OEIC pron.

The performance of the investment company will be based on but it wont be identical to the performance of the securities and other assets that the investment company owns. 80a-1 et seq or trusts provided all investments and investment practices of the investment company or trust would be permissible if made directly by the credit union or. The terms OEIC and ICVC are used interchangeably with.

Regulation 26 The Open-Ended Investment Companies Regulations 2001. The Open-Ended Investment Companies Regulations 2001 SI 20011228. Regulations are made this 29th day of October 2003.

The Open-Ended Investment Companies Investment Companies with Variable Capital Regulations 1996 first introduced the OEIC on 11 November 1996 and in force on 6 January 1997. Regulation 15 The Open-Ended Investment Companies Regulations 2001. Regulation 21 The Open-Ended Investment Companies Regulations 2001.

The Open-Ended Investment Companies Regulations 2001 SI 20011228 Content referring to this primary source. UK Open-Ended Investment Companies OEICs are collective investment vehicles established as companies and regulated by the Financial Conduct Authority FCA in the United Kingdom. Please contact Technical Support at 44 345 600 9355 for assistance.

By the Company OEIC Open-ended investment companies OEIC Regulations the Open-Ended Investment Companies Regulations 2001 SI 20011228 as amended from time to time ordinary resolution a resolution of the Company in general meeting or of a Class meeting or Fund meeting as the case may be passed by a simple majority of the. The stock is purchased when shares of the trust are bought by investors. An open-ended investment company abbreviated to OEIC pron.

Mutual funds legally known as open-end companies. Some types of open-ended investment companies. The trust is formed to invest in companies with a certain profile such as growth or value small cap or large cap.

To view the other provisions relating to this primary source see. ɔɪk or investment company with variable capital abbreviated to ICVC is a type of open-ended collective investment formed as a corporation under the Open-Ended Investment Company Regulations 2001 in the United Kingdom. ɔɪk or investment company with variable capital abbreviated to ICVC is a type of open-ended collective investment formed as a corporation under the Open-Ended Investment Company Regulations 2001 in the United Kingdom.

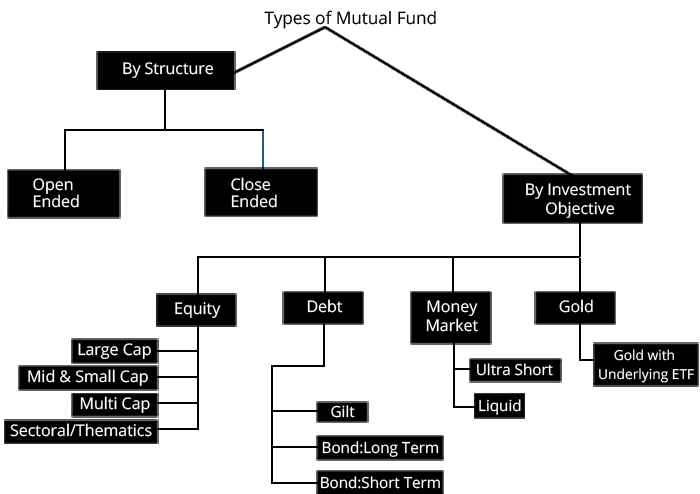

Mutual Fund Set Up And Work Flow Chart

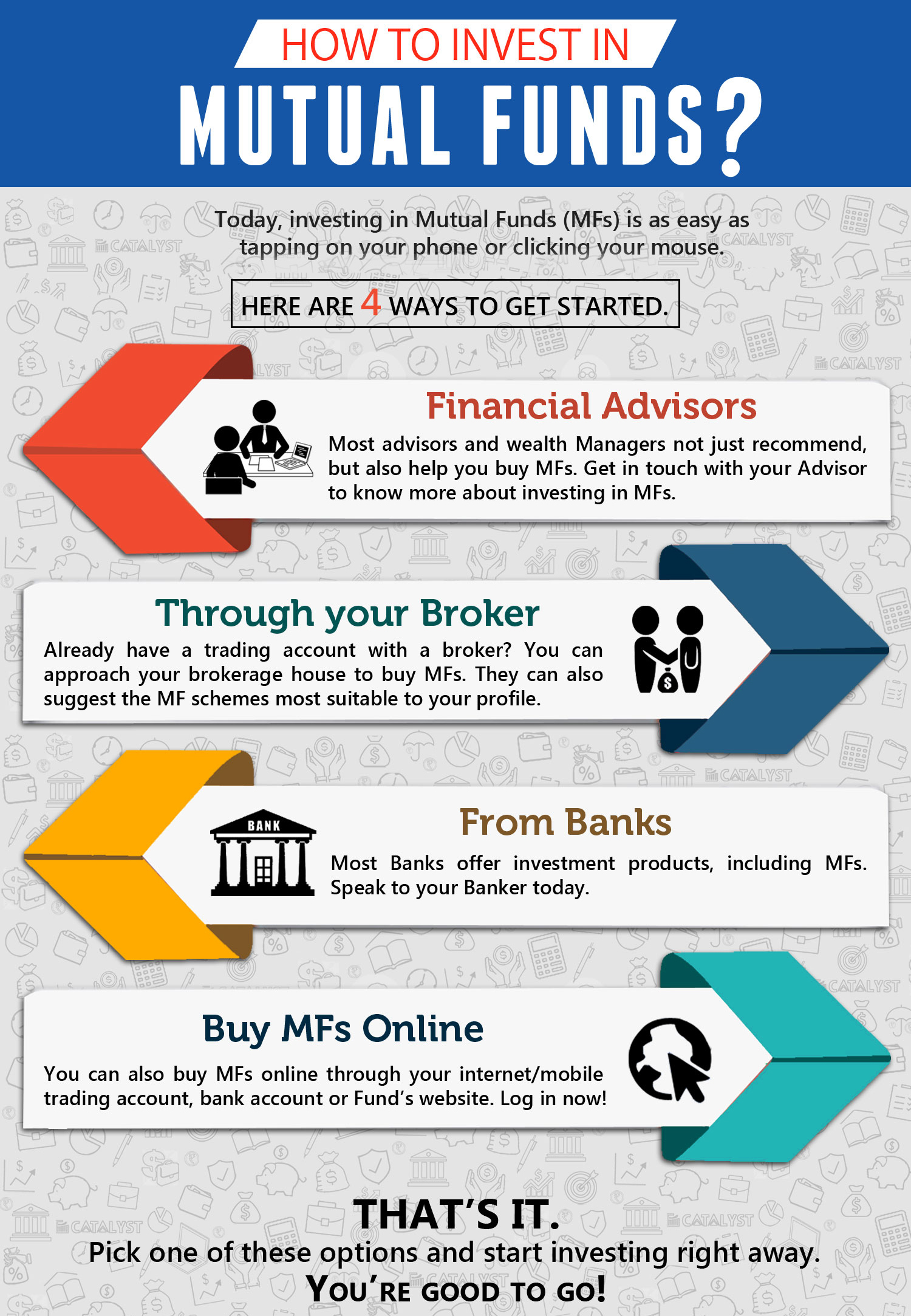

How To Invest In Mutual Funds Jamapunji

Cayman Private Funds Act 2020 Ey Us Ey Us

What Are Closed End Funds Fidelity

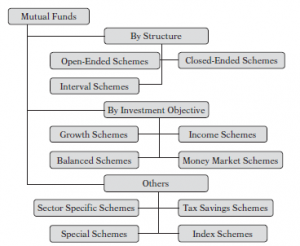

Mutual Funds An Introduction Structure Its Types Role In Capital Market Development

Open Ended Mutual Fund Meaning Benefits And How It Works

Oeic And Bonds Funds Tax Regulations Bond Funds Fund Capital Gain

Advantages And Benefits Of Investing In Mutual Funds In India

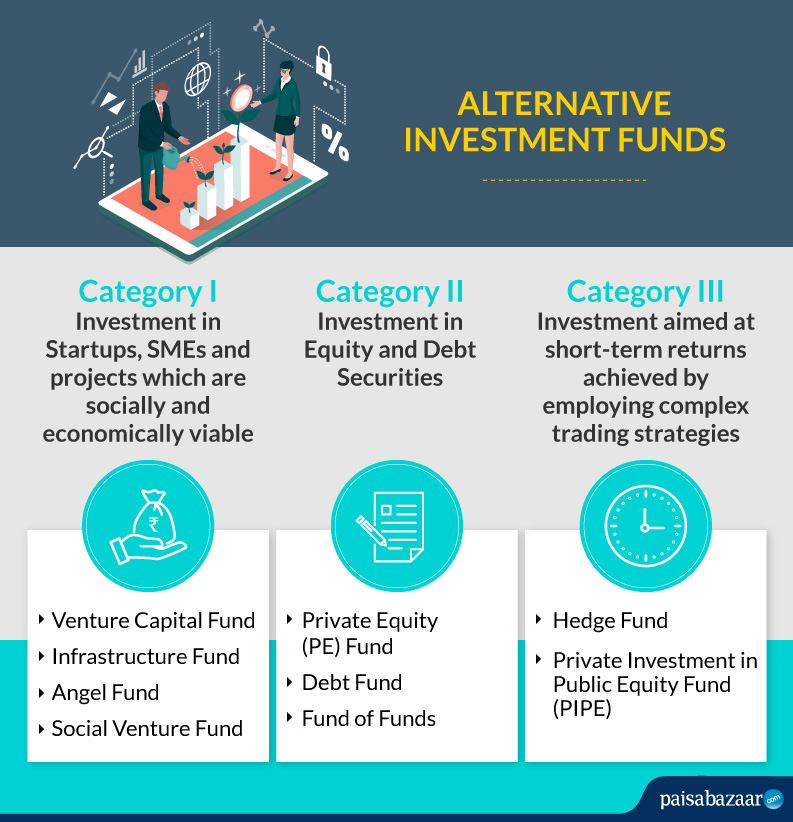

Alternative Investment Fund Know Types Taxation Rules List Of Best Aif

Mutual Fund Set Up And Work Flow Chart

/GettyImages-616128044-e7ff49f037074c9682f52d0e5a8a4842.jpg)

Undertakings Collective Investment In Transferable Securities Ucits Definition

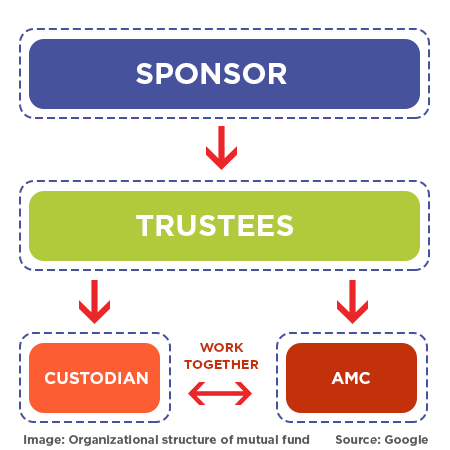

Structure Of Mutual Funds Three Tier Structure Sponsor Trust Amc

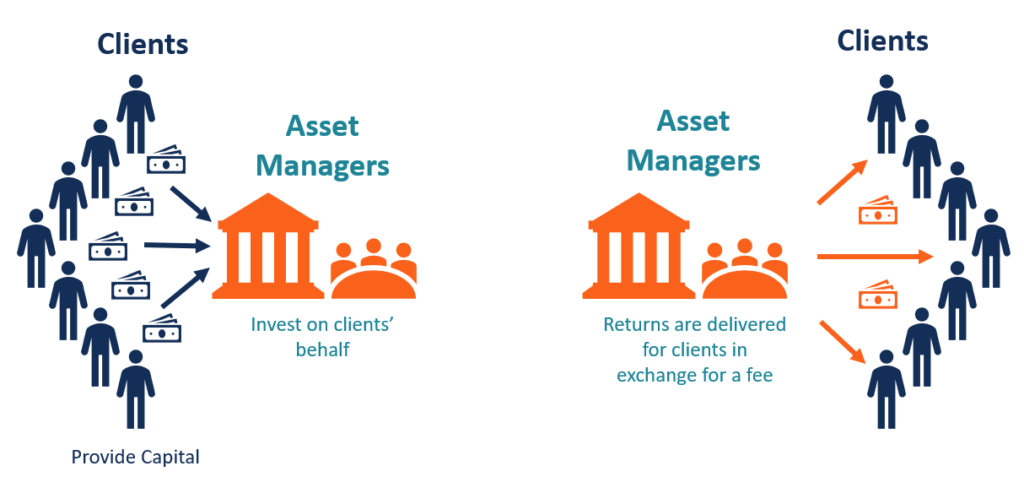

Asset Management Company Amc Overview Types Benefits

/london_stock_exchange-113017429-d2af52b2c72b427e8043a62cb5e01778-0b36a05ede834f7b84942c9b1b2c8bee.jpg)

Open Ended Investment Company Oeic Definition

Mutual Funds An Introduction Structure Its Types Role In Capital Market Development

/GettyImages-172204552-a982befe78f94122afee99916a7a4704.jpg)